Giving

WIU Home > Welcome to Gift Planning > Ways to Give > Gifts from Retirement Plans > At Death

Gifts from Retirement Plans at Death

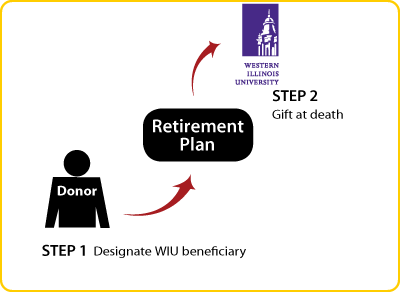

How It Works

- You name Western Illinois University as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to Western Illinois University

- No federal estate tax on the funds

- You make a significant gift for the programs you support at Western Illinois University

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

Next Steps

© Pentera, Inc. Planned giving content. All rights reserved.

Connect with us: